401(k) ROLLOVER

Consolidate your investments.

You work hard for your money, don’t leave some of it behind.

Why Now?

Whether it’s your old 401(k) or current one you can have a consolidated view of all your investments and track your wealth in one place.

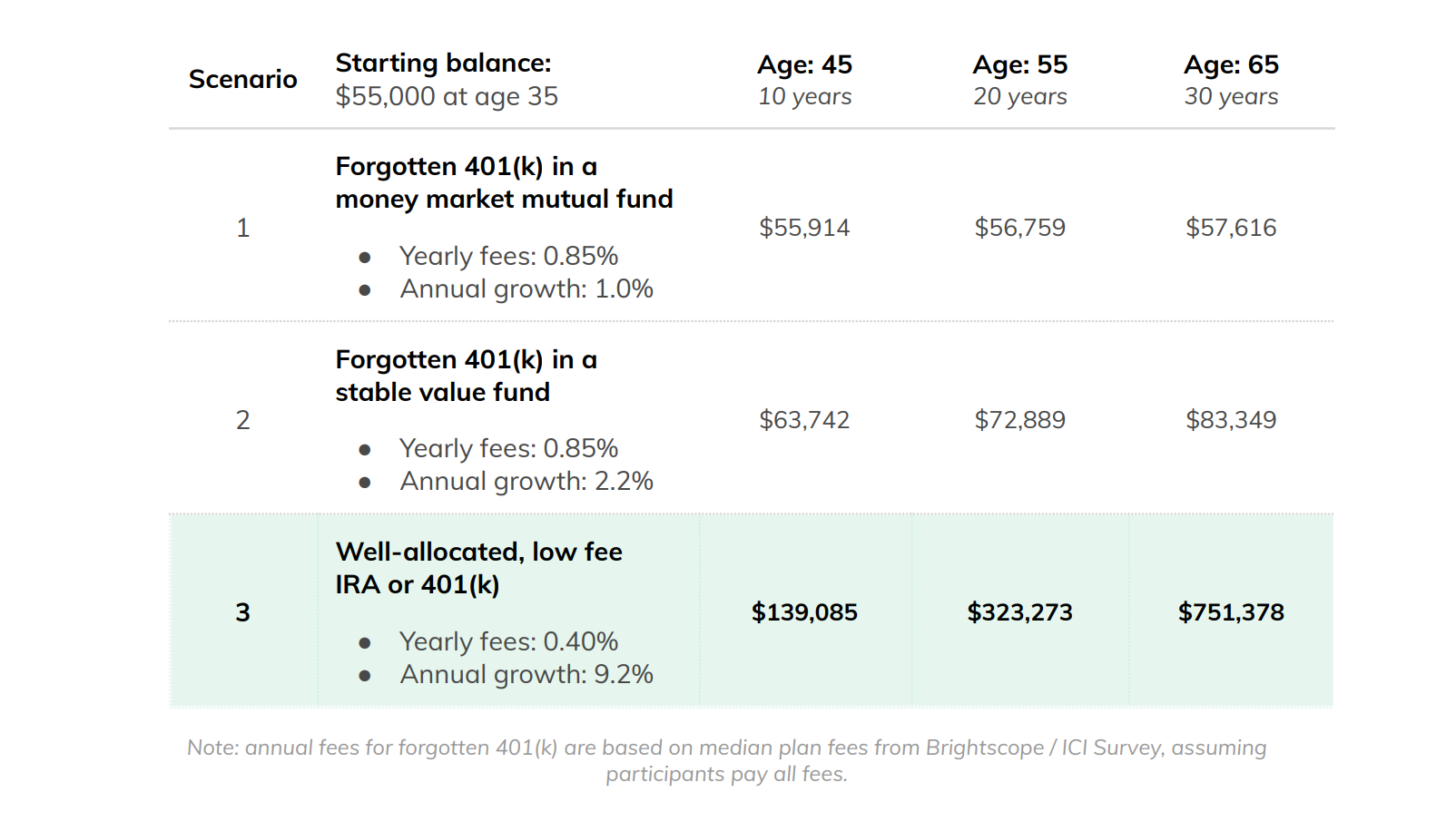

A well-allocated retirement account in the long term could yield nearly $700,000 more to use towards retirement over 30 years — or about 13x more than a forgotten 401(k) in a low-return investment.

Did you know...

Annually about 2.8 million 401(k) plans are left behind in the United States.

Did you know...

Americans will have nearly $1.35 trillion left behind in retirement accounts that are connected to previous employers.

Did you know...

Workers had an average of 4.5 jobs when they were 25 to 34 years old, and 2.9 jobs when they were 35 to 44 years old.

When you invest with us, you know you have experienced professionals, managing & monitoring your account on your behalf, making sure your money is working hard for you.

SIMPLE, TRANSPARENT PRICING

Your fee covers all transactions, trades, transfers, rebalancing, advice, and account administration. Unlike many other companies, we do not charge you additional transaction fees. We will show you the potential tax impact of withdrawal or allocation changes.

CONSOLIDATE YOUR INVESTMENTS

Whether it’s your old 401(k) or current one you can have a consolidated view of all your investments and track your wealth in one place.

TAX COORDINATED PORTFOLIOS

With a TCP, you have the potential to increase your portfolio value by an estimated 15% over 30 years. Tax-Coordinated PortfolioTM (TCP) can boost after-tax returns by an average of 0.48% each year, which approximately amounts to an extra 15% over 30 years.

How Do You Know If A Rollover Is Right For You?

OPTION 1: Leave it

This is sonly if your former employer permits it. If so, this can be an option for those with higher incomes. This option lets you continue tax-deferred growth potential; however, you can no longer contribute to the old plan.

OPTION 2: Withdraw it

If you withdraw the money from your 401(k) plan, your cash distribution will be subject to state and federal taxes and a 10% withdrawal penalty may apply. Also, your money won’t have the potential to continue to grow tax-deferred.

OPTION 3: ROLLOVER TO AN IRA

Typically this is your best option. Rollover to an IRA consolidates your retirement accounts in one place while continuing tax-deferred growth potential. You’ll get a wide range of investment options, including having us manage your money for you.

OPTION 4: MOVE TO CURRENT EMPLOYER

Not every employer offers this option. If allowed, this option lets you consolidate your 401(k)s into one account while continuing tax-deferred growth potential. But investment options vary by plan and are limited to the employers discretion.