INVEST INTELLIGENTLY

Investing, just like it should be.

You’re busy being world class at what you do best, let us do the heavy lifting for you.

How it Works:

STEP 1: Choose Your Investing Plan

Your investing plan will be primarily centered around your goals and how many accounts you’ll need to achieve them + how many new investment opportunities you want to each month

STEP 2: CHoose Your Account Type(s)

Do you want this to be an IRA, Roth IRA, or Brokerage Account etc.

STEP 3: select your portfolio(S)

Based on your investment goals, choose from our hand-crafted portfolios.

STEP 4: Choose Your Investment Size

This is the amount you want to invest. To make it simple you can choose one investment size for each account.

STEP 5: Choose Your Investment frequency

That’s one-time, monthly, Quarterly etc. Don’t worry you can change this at any time, at this point in the process it is for informational purposes only you will receive an invitation to our back-end platform where we actually manage the investments

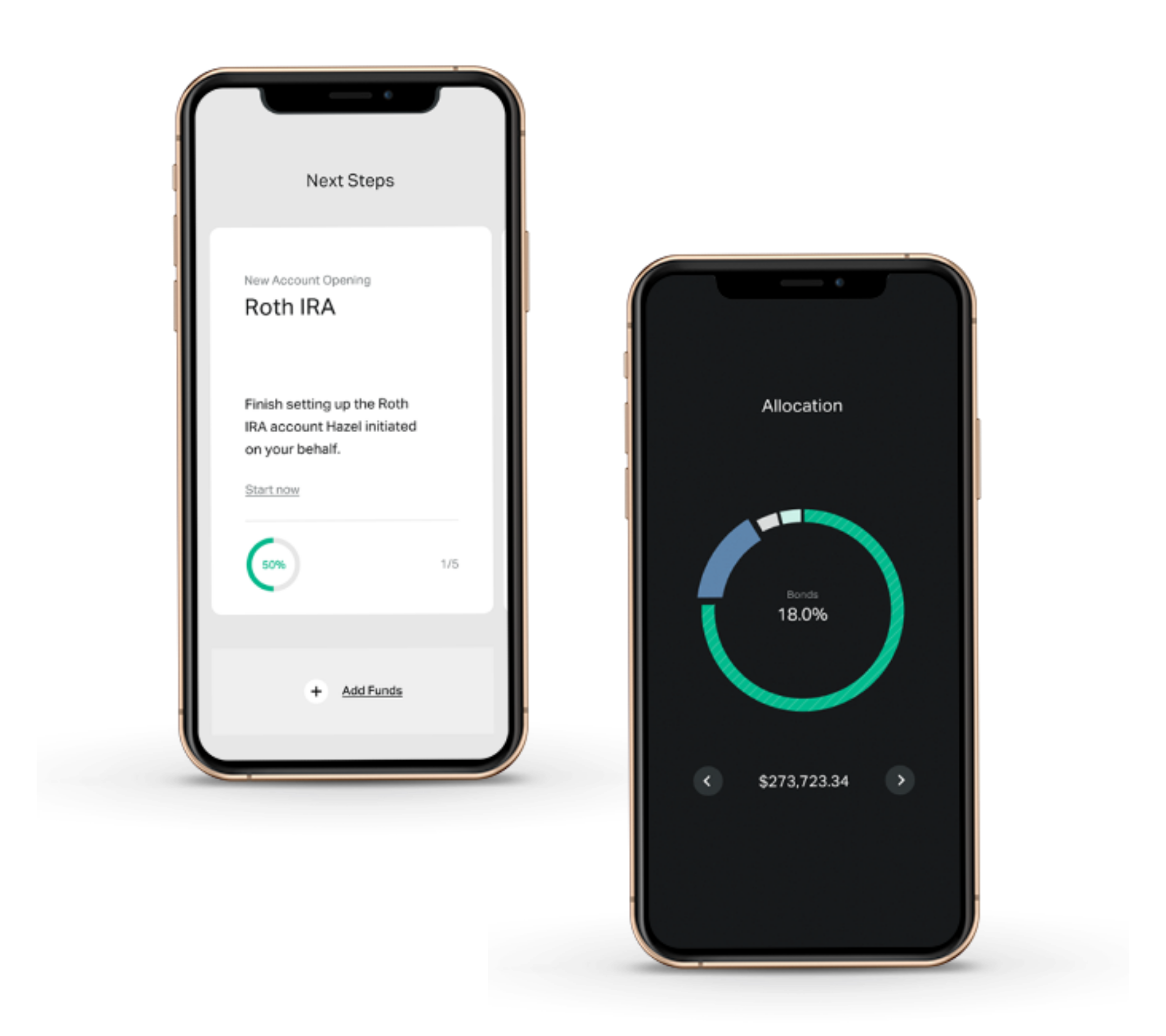

STEP 6: Open Your account

Be sure to provide all information requested because it is required to get your account opened. Be on the lookout for confirmation and next steps to finalize your account setup.

***Once You complete investment form, your money has NOT been invested. You must complete the process to establish your account in a few easy steps once we receive your confirmation, we will begin initiating that process within 2 business days.

When you invest with us, you know you have experienced professionals, managing & monitoring your investments on your behalf, making sure your investments are working hard for you.

When Advisors can do their best work, your investment can earn up to 3% more overtime, what does 3% more overtime look like?

With Advisor

Without An Advisor

As your portfolio grows, our fee does not. We don’t tie our investment fees to your account size like most firms. It remains flat even as your investments grow, which can make a huge impact overtime.

Without Direct Billing

$15,000 Account at 1% Fee

With Direct Billing

$15,000 Account

Let’s see what happens as your account grows…

Without Direct Billing

$50,000 Account at 1% Fee

With Direct Billing

$50,000 Account

Our fees were already low, now they are even lower.

transparency

Our firm is a fee-only Registered Investment advisory firm. We do not charge based on a percentage of your assets, hidden fees, or transaction cost, we charge one, low transparent fee to manage your investments.

tools

The tools available to most advisors are outdated and expensive which forces even good advisors to pass the cost on to you. We have access to cutting edge software that allows us greatly reduce our fees.

technology

Our AI Software helps us identify ways for you to get higher returns while paying less in taxes and fees.